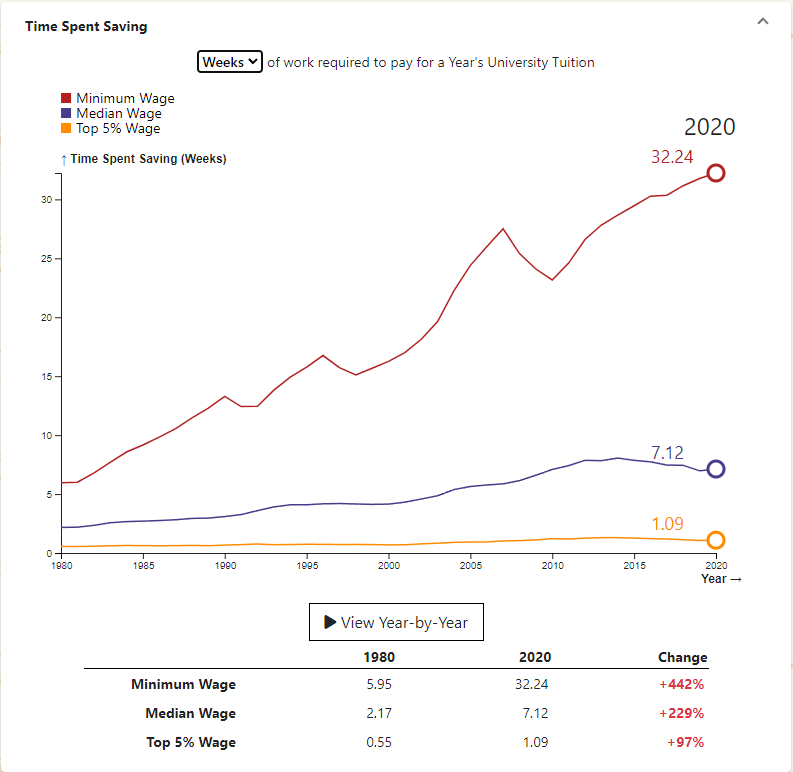

Workers have to work for a longer period of time in order to afford University Tuition than they used to in 1980. The trend is hardest on minimum wage workers who have to work 32.24 weeks of full-time work in 2020 to afford tuition, compared to 5.95 weeks of full-time work in 1980. This ignores taxes and assumes all money earned is put toward tuition.

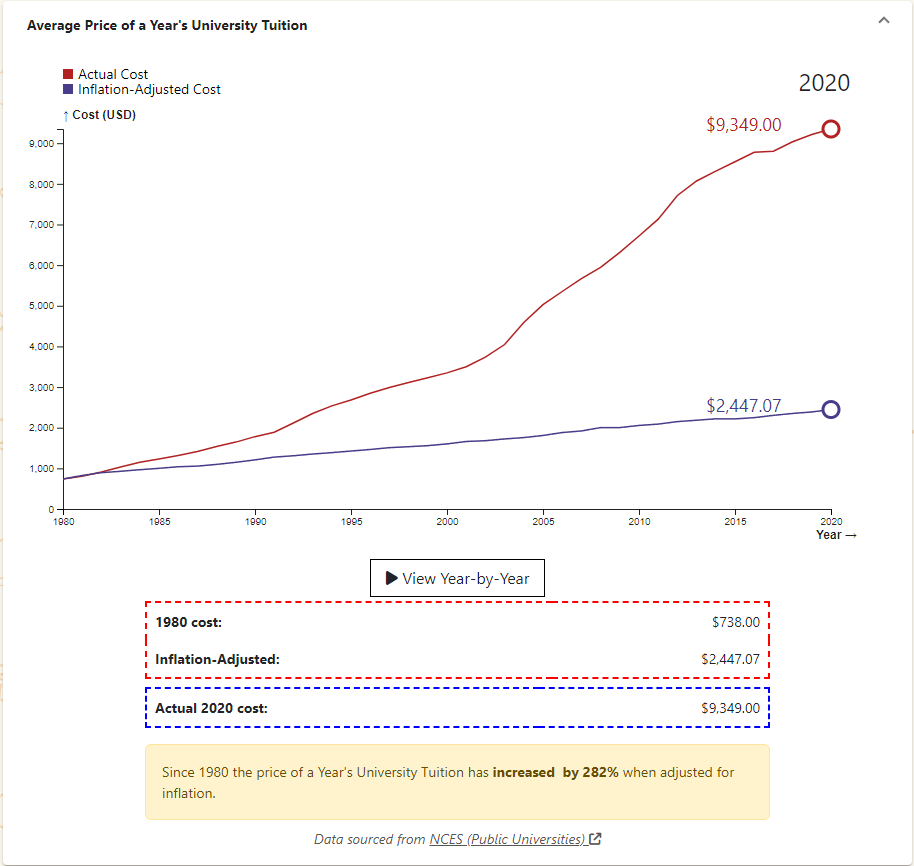

Since 1980 the price of a Year’s University Tuition has increased by 282% when adjusted for inflation.

Wages have gone up nominally, but not as much when accounting for inflation. The minimum wage has decreased since 1980 after adjusting for inflation.

Sources:

- Median and Top 5% Income: Census.gov (Table H-3)

- Minimum Wage: Department of Labor

- Year’s University Tuition: NCES (Public Universities)

Visualized on boomerchecker.com

Edit:

- Fixed an error when converting Median and Top 5% from annual to weekly. The time to save for those two brackets rose as a result.

- Added wage data for the different wage brackets for reference.

This data is sad

Moreso just says minimum wage is terrible. I’m actually pretty surprised that college went down recently relative to median wage.

It’s ridiculous we don’t just peg minimum wage to some index of local cost of living and forget about it.

This graph is also misleading it show the cost in weeks for a New York college but uses a federal minimum wage (7.25/HR) instead of the New York State minimum wage (14.20/HR) which would bring down the weeks to around 16.

*It was pointed out this wasn’t for a New York college so this isn’t perfectly accurate. Though I think referencing the federal minimum wage is a bad idea.

Hmm, looks to me like this is an average of lots of colleges around the nation, not just New York. Where are you getting that info?

https://nces.ed.gov/programs/digest/d21/tables/dt21_330.10.asp

Looks like my reading comprehension failed me. Sorry for the bad assumption.

It would be interesting to have a more region-specific breakdown of this information, especially since the U.S. is so big and costs (and minimum wages) vary widely from place to place. I haven’t been able to find more granular data, though.

It’s definitely not a good trend ☹️

How much work does it take to label your axis?

Updated for humor - but in all seriousness good data visualization on how out of reach college is becoming for an increasing amount of people. Your accounting for all wages being absolute take home also drives home the fact that the # of weeks required is going to be much much higher.

Hahaha, fair enough. I threw some axis labels on there.

College has just been out of reach for me. At 15 I had to start working to help my family get by. It was hard not to feel contempt, because I love learning. I’m also more of a “flapping in the wind” person for sure, so back then I’d probably have done meh in college lol.

I try not to let it hamper my self education, but only so much I can do. Most of my peers went to college, and I feel like we have just very very different experiences in the world. I remember when my friends started at school, and they were from fairly well off families, and I thought it was funny that their biggest lessons were how to function as an adult, while I had been doing that for a time already. It was hard not to scoff at higher education which was an unhealthy defense mechanism on my part.

I appreciate all you people out there looking out for me and feeding me specialized bits of knowledge that I lack.

I feel like most people on lemmy are just way more educated than I am, and there is still some feelings I have that I don’t like within my self. Like the need to maybe overcompensate, which is really dumb, but there is also a fair amount of “talking down to” that I have experienced from educated people I really consider my peers on an intellectual level.

I’m just rambling and my experience is obviously more nuanced than what I can formulate here.

We need to fix education, which is a sympton of the economic system itself imo. Not everyone can go to college, thats a design. There needs to be human sacrifices for the well being of many, and that’s really sad. At the end of the day, I wouldn’t trade my experience for anything. End rant.

There are tons of free accredited courses online. You can get certain degrees from Harvard and Yale, online for free. I don’t want to link to Reddit, but there is a community over there that just archives the links to the courses.

It may take you a bit longer, but one course at a time at your own pace is an extremely easy way to accidentally get a degree.

I live in New Hampshire, where annual in-state tuition is $15,520. Now I feel REALLY bad.

$8,192 for in state at University of California, and we aren’t the cheapest. IIRC that is Kansas or Missouri.

I’m confused. In the 5% bracket, a $16k tuition: this comes out to like a 900k/year job…is that where the top 5% is?

I added the wage data for each bracket to the OP for reference. I did have an error where I was dividing the Median and Top 5% annual wages by 40 instead of 52 to get the weekly wage. I fixed that and updated the OP. The average wage for the Top 5% in 2020 is $447,570 annually or $8,607 weekly, so for $16k tuition it would take 1.86 weeks of saving for a Top 5% earner. However the average tuition is $9349, so it would only take 1.09 weeks for a Top 5% earner to save that much.

And 5.5 weeks for median? That puts the median salary at around $160k - that doesn’t seem right.

Even the 30 weeks for minimum (at 7.25) should be more than a year at 16k. (And- I’ll tell you what, I wish out of state tuition at a state school was only $16k)

What’s that dip around 2010

The minimum wage was raised in 2007, 2008, and 2009 to its present value of $7.25, so the amount of minimum wage required to save for tuition dropped at that time.

Honestly that really puts into perspective how cheap it is lol.

I wouldn’t say that’s the case. Remember that this is for one year. For many careers, you need four years minimum. Then this also doesn’t seem to account for additional costs of living like food and housing you would need while saving.

Yeah and college SHOULD be an investment. We have 8 year car loans, it taking 8 years to pay off 4 years of college wouldn’t be bad. I say this as someone about to go in my junior year of college but I work at a crappy factory which pays for tuition for me after each semester, which is extremely common. And costs of food and housing are separate to tuition, which I’d all the schools are in control of. Also, my food and housing is 95% of my income. If you don’t work for four years then you taking 8 years to pay it off isn’t horrible. The issue is charging interest on a federally backed loan. The government should force these loans to be not for profit.

How much did it cost your parents to put you in high school? That’s how much university costs in other developed countries. There is no reason that the US can’t afford 4 more years of school for you. We aren’t magically broke after your senior year of HS.