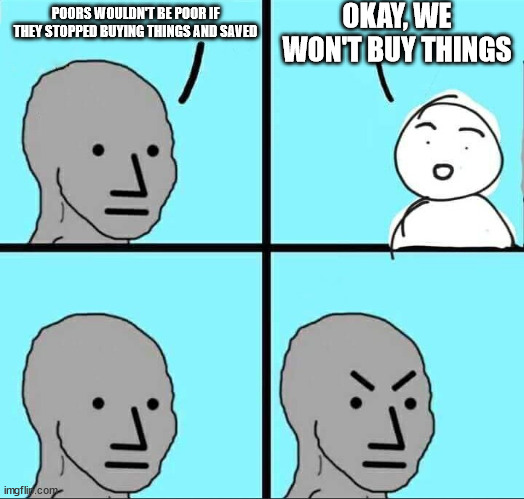

This is the “Paradox of Thrift”:

The paradox states that an increase in autonomous saving leads to a decrease in aggregate demand and thus a decrease in gross output which will in turn lower total saving. The paradox is, narrowly speaking, that total saving may fall because of individuals’ attempts to increase their saving, and, broadly speaking, that increase in saving may be harmful to an economy.[1] The paradox of thrift is an example of the fallacy of composition, the idea that what is true of the parts must always be true of the whole. The narrow claim transparently contradicts the fallacy, and the broad one does so by implication, because while individual thrift is generally averred to be good for the individual, the paradox of thrift holds that collective thrift may be bad for the economy.

the paradox of thrift holds that collective thrift may be bad for the economy.

Collective thrift is great for the economy. It’s just bad for corporate parasitism, economic stagnation, and cataclysmic wealth imbalance.

It renders parasitic business models as unviable and allows for the rebalancing of resources and development capital towards products that provide actual meaningful value for the vast majority of people.

No, it’s bad. It creates a deflationary spiral that kills all kinds of businesses. Japan’s economy has been fucked for decades by low growth because of deflation.

If people don’t spend money, companies fire workers. Then people spend less money because they have no jobs. So companies fire even more workers. Thrift is bad in aggregate.

I like to remind people that the last time we had a really bad deflationary recession, it was so bad that we called it a “depression”…

The major difference between that and what Japan is experiencing is that The Great Depression was cause by inflationary causes, not deflation, and the US government printing more money wasn’t going to help there. Meanwhile Japan has been printing boatloads of money for decades trying to trigger inflation, and are barely managing to stave off deflation.

The other major difference is that during The Great Depression, US couples were having children. Japan has been in a population Freefall the entire time.

Well inflation generally is just people with money and people with power agreeing to lie to each other, so the whole thing can continue working for them.

imagine this: you own a company, your company made raw profit of 300’000 last year. This year it made 3% more raw profit. where did that come from? Growth! or inflation? both? (the real answer is your company made 30% more, because you’ve fired all the good, expensive workers and in three years the whole thing goes bust)

It gets created when money travels hands, but someone says: I give you 100’000$ value(chicken eggs par example), you give me 100’000$ chash/numbers, but in reality most people only ever receive 99’800 (chicken eggs) -> a devaluation.

The money supply only ever grows because banks can just loan more money than thry have, but then it all gets paid back and suddenly there is more money in the system.

Combining the two (devaluation in transaction and Oversupply) equals a general trend of having more and more money (cash/numbers) while having proportionally less worth. (even though there may have been true growth, the amount of moneys ahs grown stronger/faster.)

The opposite would be you’re paying 1’000’000 and receiving a higher worth, in the end the system loses money proportional to the worth. Deflation happens.

In my mind Inflation is good when it makes products cheaper because people hate having to pay “more” for the “same”. and when it sucks the money out of the pockets of people sitting on it. (*it can also help normal people in debt, because dept usually only grows slightly, while the people increase their income and money)

However most people with money also invest it in ways where they arent just sitting on it. and most normal people dont actually have a job whit money pegged to inflation, so they just get arsed with minimum pay from the early 1990’s.

“Japan’s economy has been fucked for decades by low growth because of deflation.” I disagree, it has been a very differemt system compared to the US, but it also has a significalty different culture for example. Japanes people are quite wealthy, they have healthcare, they can eat sushi daily, they grow older than americans, are less fat than them. The japanese, in the biggest city in the world, have nowwhere near the homeless problems that plague the US. They jsut havent focused on “growth at any cost”.

an example for the systematic difference: The media cannot(is not allowed to) critisize the government in Japan. The US media isn’t doing much else except critisizing. Another Ex. may be the horrendous social problems they have, but they are mainly grounded in their fucked up culture, not their economy.

No one can eat sushi daily, that’s a myth, sushi is their version of fancy dining.

Nothing that person said made sense. Inflation isn’t good for wealthy people, it’s good for debtors.

Wealthy people hate inflation because they have lots of money and it makes their money worth less. That’s the simple explanation. In reality, they have their money mostly in bonds and stocks. But bonds are paid off in inflated currency which is worth less. So they are affected negatively by inflation.

Basically if you are a net debtor (student loans, home loans, etc.) inflation helps you as long as your income rises too. If you are a net lender (retired, wealthy, own your home with no mortgage) inflation does not help / may hurt you.

Maybe I am growing insane, maybe I am not, for sure I am not the best person to explain this (/communicate my thoughts).

“That’s the simple explanation”

This does not cut it for me, I want to know what these processes truely entail.

If you “own your home with no mortgage” Inflation does NOT do anything, since the worth and the money numbers are not the same. If you own a Housing complex in Brazil or Venezuela or whatever and suddenly the inflation jumps up 3’000% per month. Your assets arent suddenly the equivalent of an egg from Walmart. After the Shake-up has calmed down, you will ve able to raise the rent back up to a similar level as before and as such extract a similar worth from those poor Venezuelans.

The money number may be entirely different, maybe even in another currency, but the worth should stay the same.

It looks like fancy dining, because that’s how they do fast food. Take a look at a Mr. Donut. I’m not sure if any even exist in the US anymore, but compared to your local Dunkin Donuts, a Mr. Donut in Japan looks like fine dining. They serve you the donuts and tea/coffee on fine china. The place is immaculately clean. That’s just fast food in Japan. There are some extremely expensive fine dining sushi restaurants, but those aren’t the norm. Sushi is generally fast food across the lake.

A reminder to keep boycotting Kellog’s, Starbucks, McDonald’s and Nestle. :)

I’m familiar with the others, but what the heck did Kellog’s do?

Their CEO said that people who cannot afford a dinner should be eating cereal for dinner.

His wealth is increasing exponentially every year.

Let them eat Flakes: Kellogg’s CEO says poor families should consider ‘cereal for dinner’

One of the more recent things here.

Kellogg’s tried to replace workers’ contracts with notably worse ones. The workers went on strike. Kellogg’s tried to fire all of them.

Besides all of the mentioned stuff, the founder was a piece of shit

At the

riskguarantee of taking a meme too seriously…Buying, rather than saving, is how the rich get richer. They buy rentable assets. The value goes up faster than a savings account, and they have the added bonus of turning a profit along the way too. Even a company is basically a rentable asset. You pay for the privilege of using the company to make money for yourself.

If consumer activity stagnates, it’s not really a threat to the rich. The economy just rallies around servicing assets instead. And putting your money in a savings account doesn’t keep it out of the hands of the rich, either, cuz who do you think benefits from the loans the bank makes using that money?

“You need to have money to make money.”

This strategy also includes knowledge.

I didn’t learn this from my parents or school. Only later in life I learned about investments thanks to the internet.

“Now, why don’t you save

All the money you earn?”

If I didn’t eat

I’d have money to burnHallelujah I’m a bum!

Do people still say this in 2024? This ideology must be at least a decade old

Well capitalism is dozens of years old and a lit of people still believe in it 🤷

I’m skipping meals (and cutting out other things too) as part of my cost cutting strategy to save up for a dentist appointment. Guess I’m responsible for the downfall of society. 🤷

This guy definitely exists